"Learn Accounting the Smart Way – Practical. Simple. Powerful."

30 Hours of recorded Videos

100 Hours of training

Questions for Practice & Resource Kit

Online – Live Guidance for all topics

Doubt Clearance Sessions

Updates on amendments

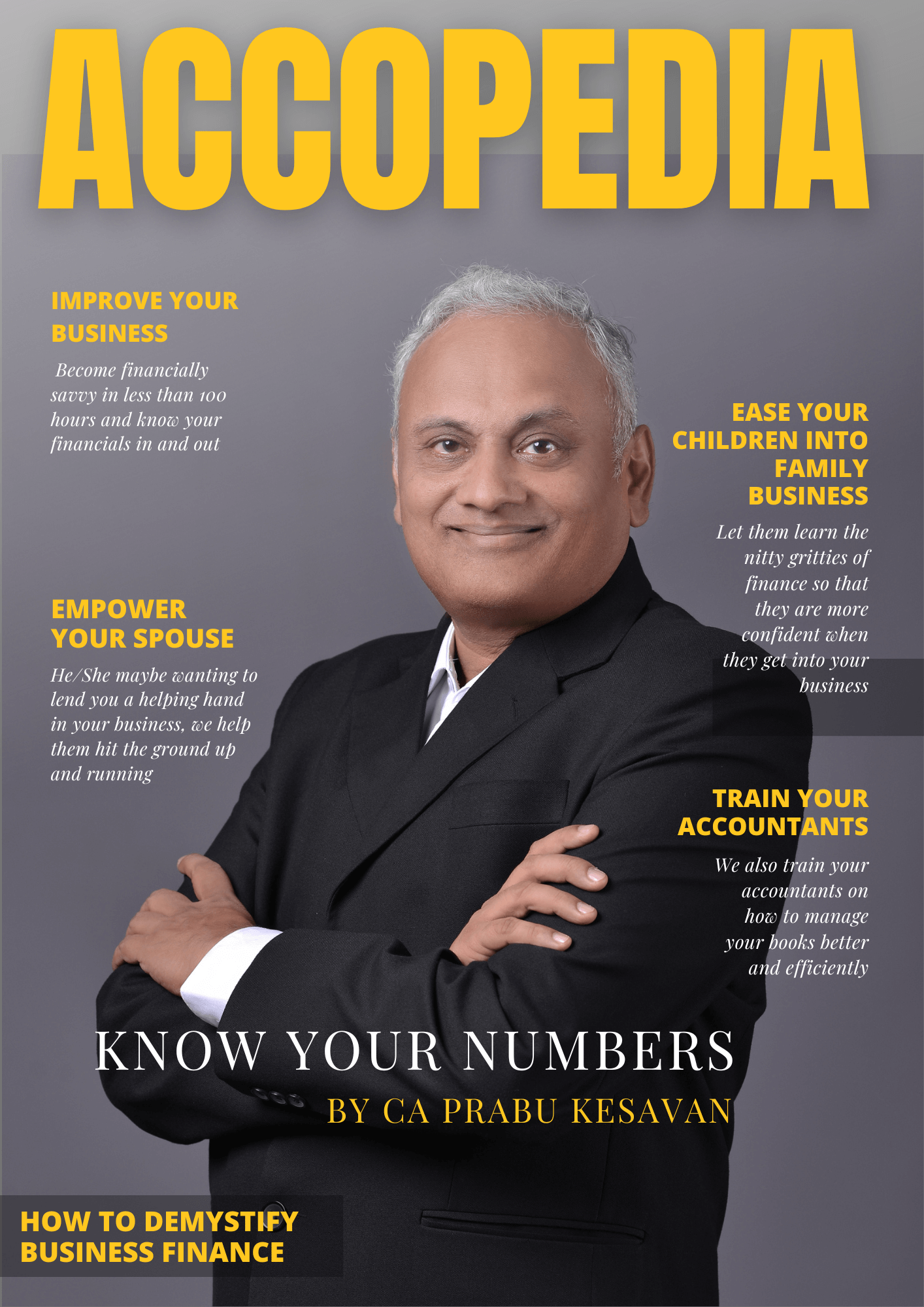

CA Prabu Kesavan

Director - Accopedia

Testimonials

Here’s what you will discover in This Course:-

The fundamentals of GST: Key concepts and terminology.

The course equips you with hands-on knowledge to handle GST challenges specific to your industry.

Input tax credits:

How to maximize your benefits.

Recent updates and compliance tips to stay ahead.

Understand GST laws and their application to day-to-day business operations.

Strategies to minimize risks and penalties.

Practical case studies and Q&A with GST experts.

Testimonials

Over 1000+ students Joined India’s top accounting school

ACCOPEDIA

Mrs. Parameshwari

Accountant, Megno

The hands-on training in this course was especially helpful in giving me the practical skills I needed to excel in my accounting career. I learned how to use accounting software, analyze financial data, and prepare financial reports, among other things.

Mr Rajamahendran

LUBRICANT SUPERVISOR, TRISTAR TRANSPORT LLC

I was impressed by the quality of the instructors and course materials in this program. They were knowledgeable, engaging, and supportive, and they helped me develop the skills I needed to succeed in the accounting industry. The support I receive from Prabu sir and his team is incomparable

Mrs. Krithika

Krithikaa Associates, Proprietor concern

Thanks to this course, I was able to secure a job in the accounting field and start my career on – the right foot. The practical knowledge and skills I gained from this training were invaluable. Prabu sir is a very approachable person

When you become a StoryParent, you can say goodbye to

- Lorem Ipsum is simply dummy text

- Lorem Ipsum is simply dummy text

- Lorem Ipsum is simply dummy text

CA Prabu Kesavan

Chartered Accountant

40+ years of experience

Director - Accopedia

Know your Mentor

Most Indian business people do not have knowledge about finance during the start of their business journey. It is after several mistakes, bad experience and several thousand penalty paid, they acquire the knowledge that too partially

Business is nothing but value creation – We create value for the customers, employees, vendors and government (through our taxes) . The government delivers its value indirectly through infrastructure development and policies and directly through schemes specifically targeted for MSMEs. But 70% of the entrepreneurs are not aware of the scheme they can use. Each of these schemes can save you several lakhs throughout your business journey

Most entrepreneurs do not budget or do not have a structured way to plan their finances. Post this course, you will be able to use your budget template to do all of these

When people enter their family business, their lack of financial knowledge puts them at a disadvantage. You can address the same using this course

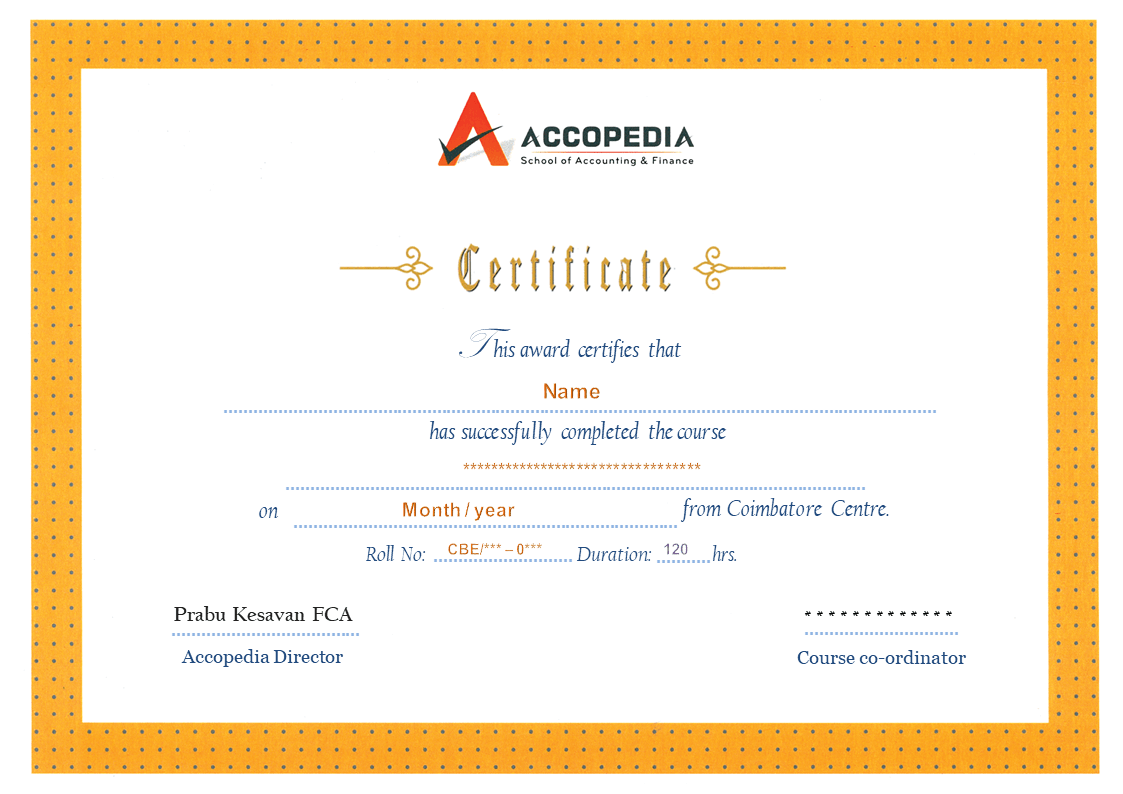

Attain Certification

Display your valid certificate

Demonstrate your expertise in tax compliance

Frequently Asked Questions

What is this course about?

This course provides comprehensive training on the Goods and Services Tax (GST) system, covering registration, compliance, filing returns, GST laws, and practical applications.

Who should take this course?

Business owners and entrepreneurs

Accountants and tax professionals

Students pursuing commerce or finance

Anyone interested in understanding GST for professional or personal use

What are the prerequisites for this course?

No prior knowledge of GST is required. A basic understanding of accounting and taxation is helpful but not mandatory.

How long is the course?

The course duration varies but typically lasts 2-3 weeks. Learners can progress at their own pace for recorded sessions.

Can I access the course materials even after completing the course?

Yes, you will have lifetime access to the course materials even after completing the course. You can refer to the course materials anytime in the future to refresh your knowledge.